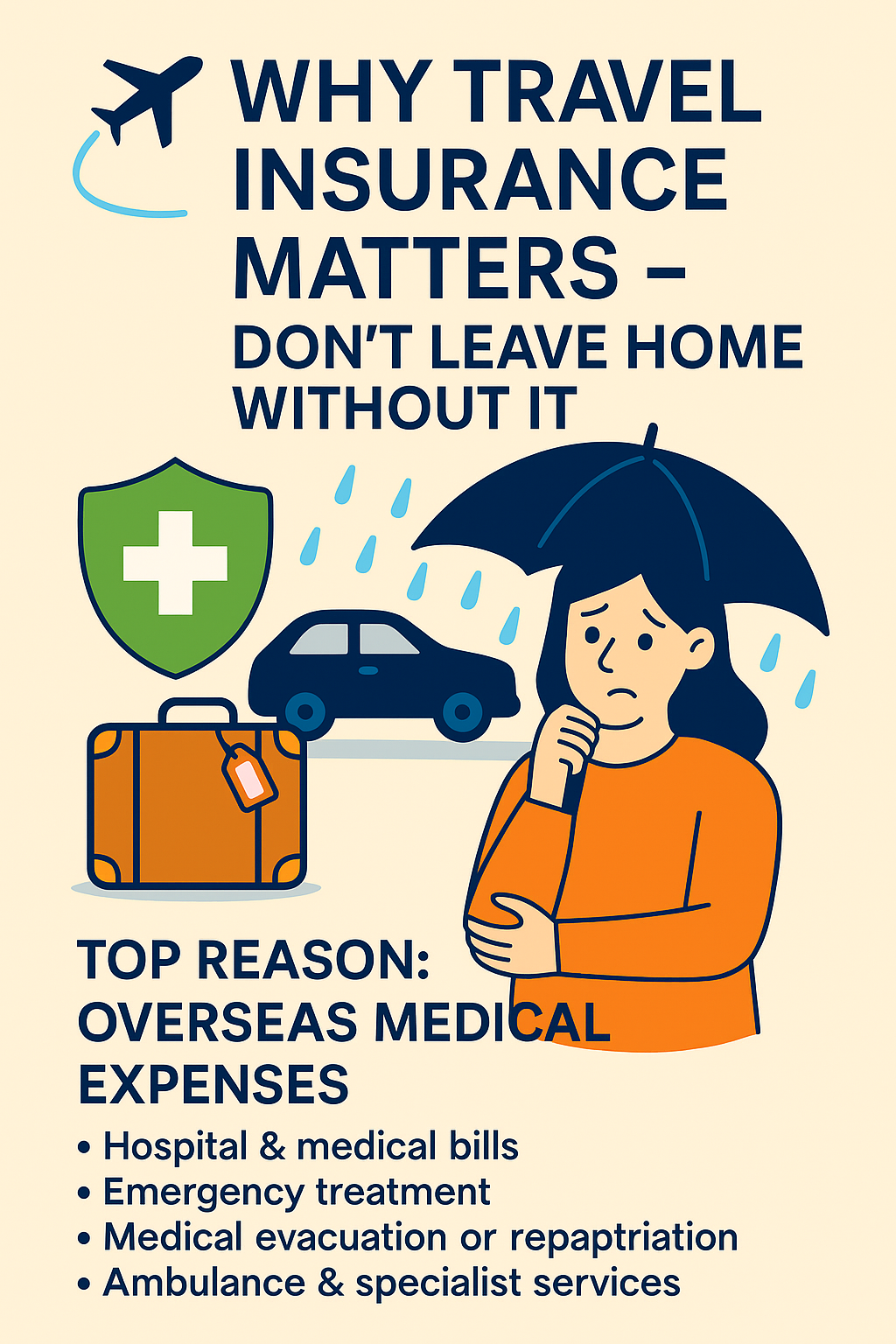

Why Travel Insurance Matters — Don’t Leave Home Without It

Planning a trip? Don’t just book flights and hotels—get protection too.

Whether it’s a quick getaway or a long overseas adventure, travel insurance is your safety net when things go wrong. And trust us—sometimes, they do.

🌍 Top Reason: Overseas Medical Expenses

Getting sick or injured abroad is stressful—and costly. Travel insurance helps cover:

-

Hospital & medical bills

-

Emergency treatment

-

Medical evacuation or repatriation

-

Ambulance & specialist services

💼 Other Key Benefits Include:

-

🛫 Trip cancellation or interruption (e.g., sudden family emergency back home)

-

⏱ Flight delays or missed connections

-

🧳 Lost or delayed luggage

-

📄 Lost travel documents

-

💥 Accidental death or permanent disablement

-

🔄 Emergency evacuation due to crisis

📆 Frequent Traveller?

You don’t need to buy insurance every time. Many insurers offer annual travel plans for regular travellers—it’s more cost-effective and convenient.

⚠️ Know the Limits

Each insurance company offers different benefits, exclusions, and optional add-ons. Some important things to note:

-

⛷️ High-Risk Activities (e.g., skiing, diving, hiking) — usually require add-on coverage

-

😷 COVID-19-related claims — some insurers require declaration and additional premium

-

🧬 Pre-existing conditions — generally not covered, including complications related to those conditions

🧾 Final Tip:

Before you buy, read the policy wording or talk to your agent. Different companies have different terms—what’s included, what’s excluded, and what needs to be added.

Need help choosing the right travel insurance?

👉 Contact us — we’ll help you find a plan that fits your trip (and your peace of mind).