What Is Compulsory Excess in Private Car Insurance – And When Does It Apply?

What is “Compulsory Excess”?

If you ever need to make a car insurance claim, excess is the portion of the cost that you, the policyholder, have to pay first before your insurer covers the rest.

Now here’s the twist:

There’s something called “Compulsory Excess” – an additional RM400 you must pay under specific conditions, no matter how good your driving record is.

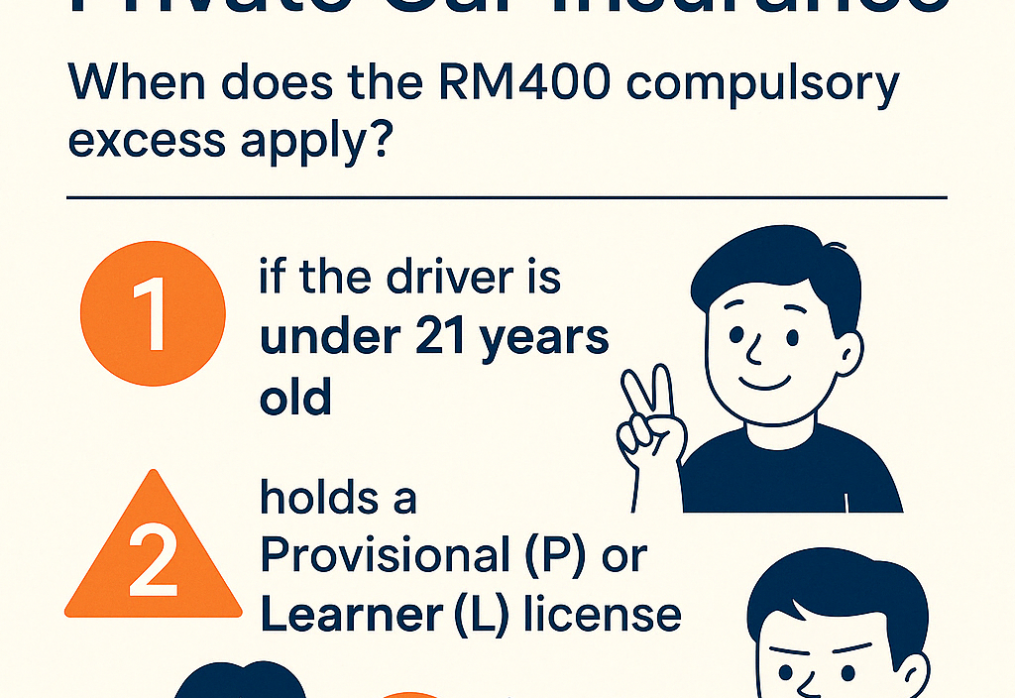

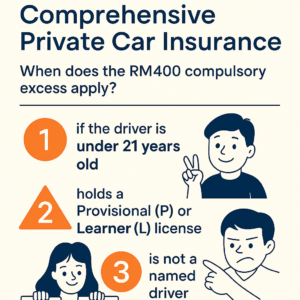

🚨 When Does the RM400 Compulsory Excess Apply?

This additional charge kicks in if the driver involved in the accident meets any of the following:

1️⃣ Under 21 years old

Young and adventurous? Yes. But also, statistically riskier.

2️⃣ Holds a Provisional (P) or Learner (L) license

These are beginner drivers still under training.

3️⃣ Not named in your policy as a “Named Driver”

If someone drives your car but their name is not listed in your insurance, this rule applies—even if they’re fully licensed.

📷 Refer to this infographic for a quick summary:

👉

💰 Example: How It Affects Your Claim

Let’s say a claim is RM3,000:

-

If compulsory excess applies, your insurer pays RM2,600, and you pay RM400.

-

If not applicable, insurer pays the full RM3,000. You pay RM0.

✅ How to Avoid Paying This Excess?

-

Name additional drivers in your policy (especially children or spouse).

-

Make sure they’re over 21 and fully licensed.

-

Consider adding a Compulsory Excess Waiver if your insurer offers it.

📜 Straight From the Policy:

“We have the right to deduct RM400 if the driver is under 21, holds a P or L license, or is not named as a driver in your schedule.”

(Source: Allianz & Generali Private Car Policy Wording)

👀 Final Thought

Most people only learn about “compulsory excess” after an accident.

Don’t be one of them.

Review your policy today—or better, let us review it for you.