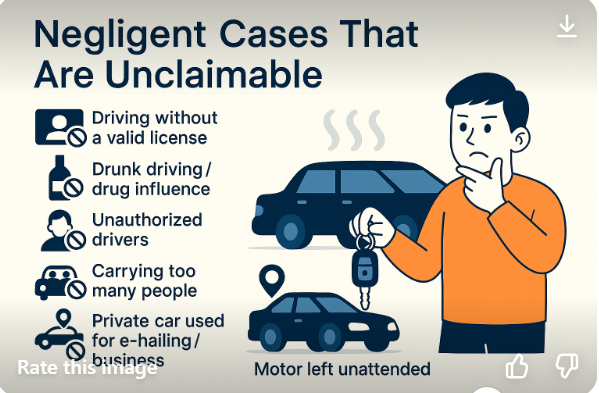

Negligent Cases That Are Unclaimable

Negligent Cases That Are Unclaimable — What You Must Know Before You Drive

Some accidents may seem minor — but one careless mistake could cause your insurance claim to be completely denied.

We’re not just talking about major crashes or illegal racing. Even small oversights like having an expired license or carrying too many passengers can result in zero payout.

⚠️ Common Situations Where Claims May Be Denied

❌ 1. Driving Without a Valid License

Expired, suspended, or no license at all?

Your insurance won’t pay.

❌ 2. Drunk Driving / Drug Influence

If alcohol or drugs are involved, the insurer will void your claim completely — even if the accident was minor.

❌ 3. Unauthorized Drivers

Someone else driving your car without your knowledge?

Unless it’s reported properly and confirmed as theft by the police, you could still be held liable — and your claim may be denied.

❌ 4. Carrying Too Many People

Exceeding the legal passenger limit (e.g. 6 people in a 5-seater)?

That alone can void your coverage.

❌ 5. Private Car Used for E-Hailing or Business

Using your private car for Grab, food delivery, or commercial use without declaring it?

Your insurer may not cover any damage.

❌ 6. Leaving Your Car Unattended (With Keys Handed Over)

Just because your car was taken doesn’t always mean it qualifies as theft.

Real Case Example:

A car owner drove to a car wash and handed his keys to someone he assumed was staff.

That person drove off — and the car was never recovered.

The insurance company rejected the claim.

Why?

Because the keys were handed over voluntarily, and there was no force or break-in, the incident is not considered “theft” under standard motor insurance.

It falls under negligence, and is therefore excluded from coverage.

💡 Important Reminder

Never hand over your car keys unless you are 100% sure the person is authorized.

If your vehicle is stolen due to your own carelessness, your insurance won’t cover it.

✅ What You Can Do as a Responsible Driver

-

Keep your license valid

-

Don’t drink and drive

-

Follow your car’s legal passenger limit

-

Don’t allow others to drive without your consent

-

Declare if your car is used for e-hailing or business

🛡️ Insurance Only Works If You Drive Responsibly

At LH Insurance, we help our clients not just buy insurance — we help them understand it.

Want a quick review to make sure your policy has no hidden gaps?

👉 Contact us today — we’re happy to assist, no obligation.

💬 Final Thought

Insurance is like a safety net — but if the net is torn, it won’t catch you when you fall.

Let us help you keep that net strong.